Worthwhile

Simple, swift access right from your phone. Only a single document needed to apply

Simple, swift access right from your phone. Only a single document needed to apply

Depend on our responsible lending and innovative solutions. We protect your privacy and assist in crises

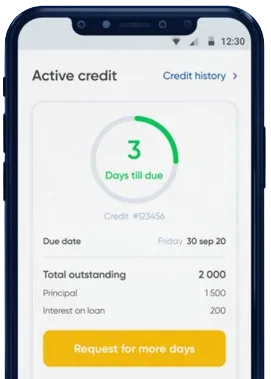

Easy and quick solutions without leaving home. Money is instantly transferred, with loan extension options

Apply through the app by completing the necessary form.

Expect a decision in as little as 15 minutes.

Collect your money, with transactions often completed in one minute.

Apply through the app by completing the necessary form.

Download loan app

Instant loans have become increasingly popular in Kenya due to their convenience and accessibility. These types of loans can be a lifesaver in times of financial emergency, providing quick and easy access to much-needed funds. In this article, we will explore the benefits and usefulness of instant loans in Kenya.

One of the primary benefits of instant loans in Kenya is the convenience and speed at which they can be obtained. With traditional bank loans often taking days or even weeks to process, instant loans provide a quick solution to urgent financial needs. The application process is typically simple and can be completed online or through mobile apps, making it easy for borrowers to access funds within minutes.

These factors make instant loans a popular choice for individuals in need of immediate financial assistance, allowing them to cover unexpected expenses or bridge a temporary cash flow gap.

Instant loans in Kenya come in various forms, offering borrowers a range of options to choose from depending on their financial needs. Whether you need a small amount to cover a minor expense or a larger loan for a major purchase, instant loans can provide the flexibility to meet your requirements.

Some common types of instant loans in Kenya include payday loans, personal loans, and business loans. Each type of loan is designed to cater to specific financial needs, providing borrowers with the flexibility to choose the loan that best suits their situation.

Additionally, instant loans can be used for a variety of purposes, including medical emergencies, education expenses, home repairs, and debt consolidation. This versatility makes instant loans a valuable financial tool for individuals and businesses alike.

Contrary to popular belief, instant loans in Kenya can be cost-effective and transparent when used responsibly. Most reputable lenders disclose all fees and charges upfront, ensuring that borrowers are fully aware of the terms and conditions before taking out a loan. This transparency helps prevent hidden costs and surprises later on, allowing borrowers to make informed decisions about their finances.

By comparing different loan options and selecting a lender with favorable terms, borrowers can ensure that they are getting the best deal possible. This proactive approach can help minimize the overall cost of borrowing and ensure a positive experience with instant loans in Kenya.

Instant loans in Kenya offer a convenient, flexible, and cost-effective solution for individuals and businesses in need of quick financial assistance. With their ease of access, variety of options, and transparent terms, instant loans can help bridge the gap between financial emergencies and long-term stability. By understanding the benefits and usefulness of instant loans in Kenya, borrowers can make informed decisions about their financial well-being and achieve their goals with confidence.

Instant loans in Kenya are quick short-term loans that can be accessed and disbursed within a few minutes or hours. These loans are usually provided by mobile lending platforms, banks, and other financial institutions.

To qualify for an instant loan in Kenya, you typically need to have a registered mobile phone number, a valid national ID, be above 18 years old, and have a source of income. Lenders may also consider your credit history and loan repayment behavior.

The maximum loan amount you can get with an instant loan in Kenya varies depending on the lender. Some lenders offer loans ranging from as low as Ksh 500 to as high as Ksh 100,000 or more. Your loan limit may also increase based on your repayment history and creditworthiness.

Interest rates for instant loans in Kenya can vary widely depending on the lender. Some lenders offer competitive rates as low as 1% per day, while others may charge higher rates. It's important to carefully read the terms and conditions before taking out a loan to understand the interest rates and fees involved.

Once your loan application is approved, you can typically receive the funds from an instant loan in Kenya within minutes to a few hours. Some lenders may take longer to disburse the funds, so it's important to choose a reputable lender with a fast approval and disbursement process.

If you are unable to repay your instant loan in Kenya on time, you may incur late repayment fees or penalties. Your credit score may also be negatively affected, making it harder for you to access credit in the future. It's important to communicate with your lender if you are experiencing difficulties repaying your loan to explore possible repayment options.